General Liability

Although we all want to think the best of those around us, we live in a very litigious society. Unfortunately, even a tiny mistake or accident can result in devastating legal action. Luckily, liability insurance in Maine can offer some protection from financial damage.

Property

Storms happen, pipes burst and thieves are always looking for their next target. If unforeseen circumstances interrupt your business operations, how much time or money can you afford to lose? The reality is that even a few days or minimal damage can be painful to recover from, but losing a few months or the bulk of your assets can be devastating.

Business Auto

Whether your company owns a fleet of business vehicles, or your employees occasionally use a personal auto for work, your business should have commercial auto insurance to protect your small business. Why? Your business can be held liable for accident damages, even if it occurs in a personal vehicle used for business purposes.

Small Businesses

As a small business owner in Maine, you understand how important it is to maximize the return on every dollar you spend. Therefore, getting the right insurance coverage at the right price is no exception. At Cole Harrison, we’ve designed special small business owner’s packages (BOP) with you in mind. These policy bundles cover your essential business insurance needs at a reduced price. (Meaning you’d spend more if you purchased each policy separately.)

Workers Compensation

No matter how careful one is, accidents do happen. Protect your employees, and your business with workers compensation insurance. It provides employees who suffer a work-related injury or illness with medical care, income replacement and disability or death benefits. In addition, it safeguards your business if you are sued by an injured or ill employee.

Inland Marine

Don’t let the name fool you. Inland marine insurance is one of the most important coverages your business can have—even if your business has nothing to do with boats or water. Initially created to cover goods transported over water, it now includes a variety of items

Umbrella

One thing is certain, life is full of unpredictable circumstances. While you can plan for and insure against the most common risks and hazards, umbrella coverage protects your business from the ones that are nearly impossible to predict.

An umbrella insurance policy is a type of insurance that provides additional liability coverage beyond the limits of your existing policies. This means it is added protection for your business.

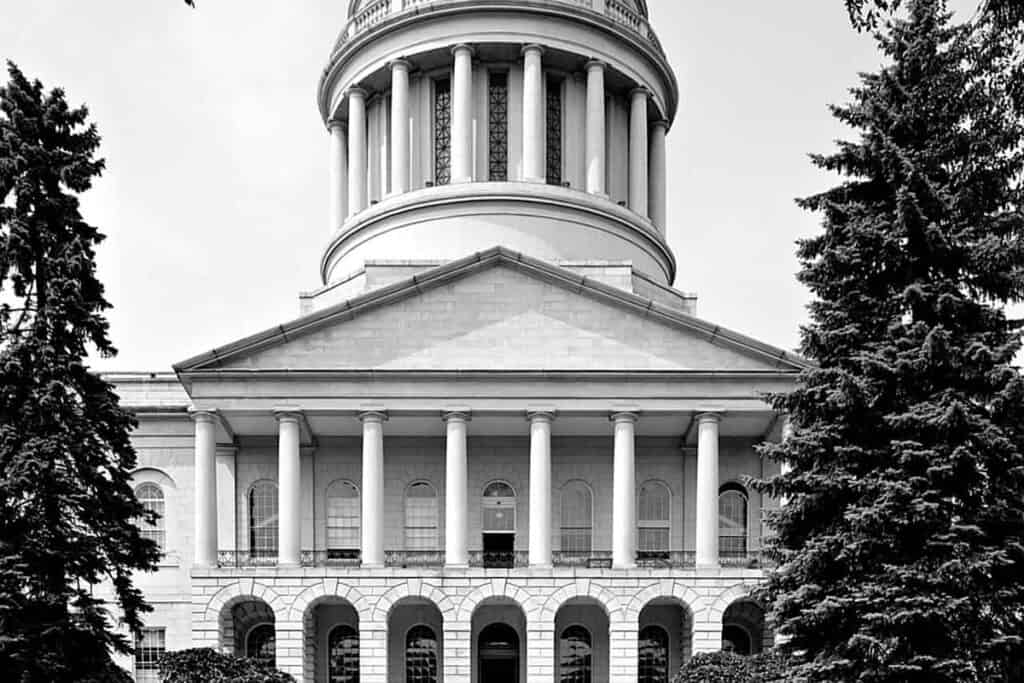

Municipal Bonds

As a small business owner in Maine, you understand how important it is to maximize the return on every dollar you spend. Therefore, getting the right insurance coverage at the right price is no exception. At Cole Harrison, we’ve designed special small business owner’s packages (BOP) with you in mind. These policy bundles cover your essential business insurance needs at a reduced price. (Meaning you’d spend more if you purchased each policy separately.)

What Does Commercial Insurance Cover?

Why Does My Business Need Commercial Insurance?

There are inherent risks to running a business. Those risks may seem far away if your business is new to the industry or if your business has under 50 employees. However, accidents happen and it’s best to be prepared for when they do rather than if they do.

Cole Harrison has been providing commercial insurance coverage to businesses in southern Maine for over 100 years. We understand how businesses can be impacted by the unexpected and why it’s important to keep your assets secure. Some of the most common commercial insurance claims we’ve seen include:

- Burglary and theft: Burglary and theft is the most common commercial insurance claim filed by business owners. Theft can happen anywhere, even if your business is completely online. Angry customers, criminals, or employees may steal items or invoices when you least expect it.

- Customer injury: Your business is vulnerable to lawsuits when it comes to customer injury if you have a brick and mortar store or place of business. All it takes is one customer or member of the public slipping and falling on your property for a lawsuit to begin. Commercial insurance coverage protects your business from legal fees should an accident insurance claim be made.

- Fire: Fires happen more often than you think, and the aftermath can be costly if you’re not covered. Not only can fires cause significant property damage but they can also destroy important documents and data.

Looking for commercial insurance protection for your business? Talk to one of our experienced Maine commercial insurance agents at the Cole Harrison Agency to learn more.